Recomendaciones INDITEX

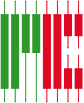

Venta

6.702

0,02%

3,4630

Compra

3.859

-0,01%

3,4615

Vol:

0

Eur:

0

Ayer:

0

Max:

31,3000

0,44%

Min:

30,6400

-1,66%

Open:

0

0,00%

5A

1A

6M

3M

60D

15D

5D

1D

La ultima recomendación del Inditex es de Jefferies y fija un precio objetivo de 67,000.

Nueva recomendación de Jefferies para Inditex, en el día jueves, 18 de diciembre de 2025 le ha dado un precio objetivo de 67,000 Euros ,es un 30,10% mas alto que la anterior recomendación,le da un potencial de subida de 18,67% respecto al valor actual de la acción.

-En los últimos 3 meses hay 4 recomendaciones:

-El precio medio es de 54,875 la diferencia con el precio actual es de -2,81%

-Hay 4 recomendaciones de las cuales 4 (100%) el precio objetivo es mayor al precio anterior.

-Y de las 4 recomendaciones 1 (25%) el precio objetivo es mayor al precio actual de la acción.

-Resumen: El 25% el precio objetivo es mayor al precio de la acción, un 100% de las recomendaciones fueron alcistas y el 0% fueron menores al precio objetivo actual.

-Hay 4 recomendaciones de las cuales 4 (100%) el precio objetivo es mayor al precio anterior.

-Y de las 4 recomendaciones 1 (25%) el precio objetivo es mayor al precio actual de la acción.

-Resumen: El 25% el precio objetivo es mayor al precio de la acción, un 100% de las recomendaciones fueron alcistas y el 0% fueron menores al precio objetivo actual.

Recomendaciones de Inditex

Bróker

Fecha

Precio Anterior

Precio Objetivo

Dif.Pre

Dif.Cot

Jefferies

18/12/2025

51,500

67,000

30,10%

18,67%

Barclays

24/11/2025

43,500

47,500

9,20%

-15,87%

RBC Capital Markets

24/11/2025

49,000

52,000

6,12%

-7,90%

Bestinver Securities

21/11/2025

52,500

53,000

0,95%

-6,13%

Alphavalue

23/09/2025

49,600

50,600

2,02%

-10,38%

CaixaBank BPI

11/09/2025

47,600

47,200

-0,84%

-16,40%

Jefferies

08/09/2025

54,000

51,500

-4,63%

-8,78%

Barclays

02/09/2025

45,000

43,500

-3,33%

-22,95%

Bestinver Securities

05/06/2025

52,850

55,000

4,07%

-2,59%

Bestinver Securities

05/06/2025

52,850

55,000

4,07%

-2,59%

JB Capital Markets

02/06/2025

48,800

47,300

-3,07%

-16,22%

Exane BNP

23/04/2025

49,000

56,000

14,29%

-0,81%

Bestinver Securities

07/03/2025

53,500

54,800

2,43%

-2,94%

HSBC

05/03/2025

55,000

57,000

3,64%

0,96%

Bernstein

16/10/2024

51,000

60,000

17,65%

6,27%

Bernstein Research

05/09/2024

50,000

51,000

2,00%

-9,67%

HSBC

04/09/2024

53,000

55,000

3,77%

-2,59%

Goldman Sachs

06/06/2024

51,000

52,000

1,96%

-7,90%

DZ Bank

06/06/2024

50,000

52,000

4,00%

-7,90%

Barclays

06/06/2024

39,000

42,000

7,69%

-25,61%

Morgan Stanley

06/06/2024

39,000

46,000

17,95%

-18,53%

Mediobanca Securities

06/06/2024

38,000

40,000

5,26%

-29,15%

Bernstein Research

06/06/2024

47,000

50,000

6,38%

-11,44%

RBC Capital Markets

06/06/2024

47,000

48,000

2,13%

-14,98%

HSBC

06/06/2024

51,000

53,000

3,92%

-6,13%

Citigroup

16/05/2024

42,500

50,000

17,65%

-11,44%

JP Morgan

14/03/2024

42,000

48,000

14,29%

-14,98%

Barclays

26/02/2024

34,000

39,000

14,71%

-30,92%

JP Morgan

22/02/2024

40,000

42,000

5,00%

-25,61%

Bernstein

08/12/2023

40,000

42,000

5,00%

-25,61%

HSBC

08/12/2023

38,520

43,500

12,93%

-22,95%

Deutsche Bank

14/09/2023

35,000

37,000

5,71%

-34,47%

Morgan Stanley

11/09/2023

37,000

38,000

2,70%

-32,70%

Bernstein

06/09/2023

38,000

40,000

5,26%

-29,15%

Citigroup

29/06/2023

35,000

38,000

8,57%

-32,70%

Deutsche Bank

20/06/2023

30,000

35,500

18,33%

-37,12%

Bernstein

15/06/2023

-

38,000

-

-32,70%

Citigroup

01/06/2023

32,500

35,000

7,69%

-38,01%

Barclays

18/05/2023

27,000

28,000

3,70%

-50,41%

RBC

24/04/2023

32,000

34,000

6,25%

-39,78%

Morgan Stanley

28/03/2023

28,000

31,000

10,71%

-45,09%

HSBC

22/03/2023

34,000

37,000

8,82%

-34,47%

UBS

17/03/2023

31,000

33,000

6,45%

-41,55%

Deutsche Bank

16/03/2023

27,000

30,000

11,11%

-46,87%

JP Morgan

16/03/2023

31,000

34,000

9,68%

-39,78%

RBC

08/03/2023

30,000

32,000

6,67%

-43,32%

Barclays

03/03/2023

25,000

27,000

8,00%

-52,18%

HSBC

15/12/2022

28,000

29,500

5,36%

-47,75%

Morgan Stanley

02/12/2022

24,500

27,000

10,20%

-52,18%

Barclays

30/11/2022

27,000

25,000

-7,41%

-55,72%

Citigroup

12/09/2022

21,000

25,000

19,05%

-55,72%

Berenberg

06/09/2022

26,000

22,500

-13,46%

-60,15%

UBS

18/07/2022

22,000

29,000

31,82%

-48,64%

Deutsche Bank

10/06/2022

21,000

22,500

7,14%

-60,15%

Jefferies

09/06/2022

26,500

27,500

3,77%

-51,29%

RBC

09/06/2022

27,000

29,000

7,41%

-48,64%

Credit Suisse

09/06/2022

22,000

24,000

9,09%

-57,49%

Morgan Stanley

09/06/2022

23,500

25,500

8,51%

-54,84%

Morgan Stanley

16/05/2022

24,500

23,500

-4,08%

-58,38%

Citigroup

12/05/2022

32,500

21,000

-35,38%

-62,81%

JP Morgan

17/03/2022

34,000

31,000

-8,82%

-45,09%

Barclays

17/03/2022

31,500

27,000

-14,29%

-52,18%

HSBC

17/03/2022

28,500

27,000

-5,26%

-52,18%

Deutsche Bank

17/03/2022

23,000

21,000

-8,70%

-62,81%

Morgan Stanley

11/03/2022

29,000

24,500

-15,52%

-56,61%

Credit Suisse

07/03/2022

26,000

21,000

-19,23%

-62,81%

RBC

07/03/2022

32,000

28,000

-12,50%

-50,41%

Berenberg

01/02/2022

21,000

26,000

23,81%

-53,95%

Goldman Sachs

19/01/2022

34,000

37,500

10,29%

-33,58%

UBS

10/12/2021

31,000

30,500

-1,61%

-45,98%

Jefferies

02/11/2021

35,000

36,000

2,86%

-36,24%

Morgan Stanley

20/10/2021

32,000

29,000

-9,38%

-48,64%

Bank of America

14/10/2021

20,000

26,000

30,00%

-53,95%

Credit Suisse

28/09/2021

25,000

26,000

4,00%

-53,95%

Morgan Stanley

21/09/2021

31,000

32,000

3,23%

-43,32%

Barclays

16/09/2021

30,000

31,500

5,00%

-44,21%

Kepler Cheuvreux

16/09/2021

32,400

37,600

16,05%

-33,40%

Deutsche Bank

16/09/2021

22,000

23,000

4,55%

-59,26%

Jefferies

14/09/2021

31,000

35,000

12,90%

-38,01%

JP Morgan

01/09/2021

32,000

34,000

6,25%

-39,78%

Deutsche Bank

25/08/2021

-

22,000

-

-61,03%

Barclays

27/05/2021

28,000

30,000

7,14%

-46,87%

HSBC

25/03/2021

29,500

32,000

8,47%

-43,32%

Kepler Capital Markets

16/03/2021

29,500

29,750

0,85%

-47,31%

JP Morgan

11/03/2021

28,000

30,000

7,14%

-46,87%

Barclays

11/03/2021

26,000

28,000

7,69%

-50,41%

Credit Suisse

11/03/2021

23,500

24,000

2,13%

-57,49%

Credit Suisse

01/03/2021

23,000

33,500

45,65%

-40,67%

Kepler Cheuvreux

16/12/2020

27,600

29,500

6,88%

-47,75%

Jefferies

09/12/2020

29,000

31,000

6,90%

-45,09%

Credit Suisse

07/12/2020

24,500

23,000

-6,12%

-59,26%

RBC

30/11/2020

27,500

29,000

5,45%

-48,64%

Bernstein

19/10/2020

29,000

31,000

6,90%

-45,09%

UBS

18/09/2020

28,500

29,000

1,75%

-48,64%

Citigroup

18/09/2020

25,500

27,500

7,84%

-51,29%

Independet Res.

18/09/2020

28,500

27,000

-5,26%

-52,18%

RBC

17/09/2020

27,000

28,500

5,56%

-49,52%

HSBC

17/09/2020

28,000

30,000

7,14%

-46,87%

Kepler Capital Markets

17/09/2020

27,100

27,600

1,85%

-51,12%

Bryan Garnier

17/09/2020

29,000

30,000

3,45%

-46,87%

Credit Suisse

17/09/2020

23,000

24,000

4,35%

-57,49%

HSBC

15/09/2020

30,000

28,000

-6,67%

-50,41%

Citigroup

11/06/2020

22,000

25,500

15,91%

-54,84%

HSBC

11/06/2020

29,000

30,000

3,45%

-46,87%

Kepler Capital Markets

11/06/2020

25,700

27,100

5,45%

-52,00%

UBS

11/06/2020

27,330

28,500

4,28%

-49,52%

Telsey Advisory Group

11/06/2020

24,000

25,000

4,17%

-55,72%

JP Morgan

21/05/2020

32,000

27,000

-15,63%

-52,18%

Citigroup

19/05/2020

26,000

22,000

-15,38%

-61,03%

Bryan Garnier

18/05/2020

30,000

28,000

-6,67%

-50,41%

Credit Suisse

20/03/2020

-

22,000

-

-61,03%

Bryan Garnier

19/03/2020

33,000

30,000

-9,09%

-46,87%

Citigroup

19/03/2020

32,000

26,000

-18,75%

-53,95%

RBC

18/03/2020

34,000

28,000

-17,65%

-50,41%

Morgan Stanley

18/03/2020

33,000

32,000

-3,03%

-43,32%

Credit Suisse

16/03/2020

24,000

21,000

-12,50%

-62,81%

RBC

27/02/2020

35,000

34,000

-2,86%

-39,78%

Berenberg

26/02/2020

22,000

23,000

4,55%

-59,26%

Citigroup

20/02/2020

31,000

36,000

16,13%

-36,24%

UBS

18/02/2020

33,000

34,000

3,03%

-39,78%

Independet Res.

12/12/2019

29,000

33,000

13,79%

-41,55%

Credit Suisse

03/12/2019

22,000

23,000

4,55%

-59,26%

UBS

11/11/2019

32,000

33,000

3,13%

-41,55%

RBC

15/10/2019

31,000

32,000

3,23%

-43,32%

Invest

16/09/2019

-

32,300

-

-42,79%

Citigroup

12/09/2019

-

31,000

-

-45,09%

Independet Res.

11/09/2019

27,000

29,000

7,41%

-48,64%

Credit Suisse

11/09/2019

21,000

22,000

4,76%

-61,03%

RBC

19/07/2019

30,000

31,000

3,33%

-45,09%

Bryan Garnier

13/06/2019

33,000

31,000

-6,06%

-45,09%

RBC

06/06/2019

31,000

30,000

-3,23%

-46,87%

Jefferies

13/05/2019

27,000

25,000

-7,41%

-55,72%

RBC

29/04/2019

30,000

31,000

3,33%

-45,09%

Jefferies

27/03/2019

32,000

27,000

-15,63%

-52,18%

Morgan Stanley

25/03/2019

21,000

20,000

-4,76%

-64,58%

HSBC

19/03/2019

34,000

32,000

-5,88%

-43,32%

Kepler Cheuvreux

14/03/2019

29,500

28,700

-2,71%

-49,17%

RBC

14/03/2019

32,000

30,000

-6,25%

-46,87%

JP Morgan

14/03/2019

35,000

33,000

-5,71%

-41,55%

UBS

26/02/2019

33,000

32,000

-3,03%

-43,32%

Citigroup

26/02/2019

-

31,000

-

-45,09%

RBC

04/01/2019

-

32,000

-

-43,32%

Credit Suisse

20/12/2018

24,000

21,000

-12,50%

-62,81%

Independet Res.

13/12/2018

29,000

27,000

-6,90%

-52,18%

Importante: Las Recomendaciones de los brókers son importantes porque es el valor que ellos creen que vale la acción, y es el precio que dan a sus clientes como orientación después de su estudio. Sin embargo puede variar mucho de un bróker a otros dependiendo el método que hallan usado para calcular el valor o intereses que tengan dentro del valor..

MODO PRO

Añade un valor a su cartera

X

Borrar Valor

Cancelar

Contratar Servicios

X

Tienes 0 Créditos

Contratar

Cancelar

Añade un valor a su cartera

X

Nombre Valor:

Cartera:

Precio Compra:

Titulos:

Comisiones:

Coste Total:

0

Precio Actual:

0

Plus/Minus:

0

Fecha Compra:

El servicio cuesta 1 crédito al mes.

Añadir Valor

Cancelar

Buscar Valor

X

ULTIMAS BUSQUEDAS

Buscar Usuario

X

Ticker

Nombre

Mercado

Creditos

Creditos

Bus.Valor

Bus.Valor

Conectar

Conectar

Bus.User

Bus.User